Last month we helped Brigit members check up their financial health with the Brigit FinPulse Survey. We at Brigit believe that your financial health is just as important as your physical health. This survey was designed as a subtle reminder to check your financial health and take actionable steps to improve it. Are you ready to check your financial pulse? This videos will show you how.

The FinPulse tool will allow you to compare yourself with other Brigit members and people throughout the United States. Results from this tool will help you make your financial health powerful instantly. The tool will help you know more about your spending, saving, borrowing and planning.

Let’s look at the results by each of these categories :

Spending

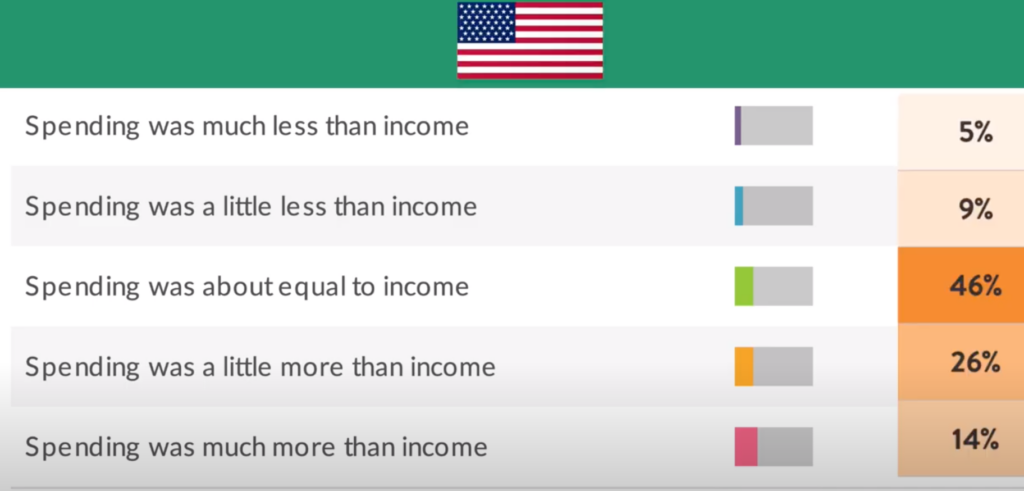

We compared Brigit members spending habits to the rest of the national population and saw that 28.7% of Brigit users were spending more than their income, whereas the national US average of 46% of the population tends to spends equal to income.

Brigit Users Spending Habits

National Population’s spending habits

Don’t be disheartened if your results aren’t satisfying because knowing where you stand in terms of your income is the first step towards attaining better financial health. That’s why we built our free budgeting tools to help you compare your spending compared to your income and help you stay accountable. Now, its time for the good news. We found that majority of Brigit users make their payments on time, the national average is about the same as well. If you want to learn more about managing your spending habits watch the following video.

Saving

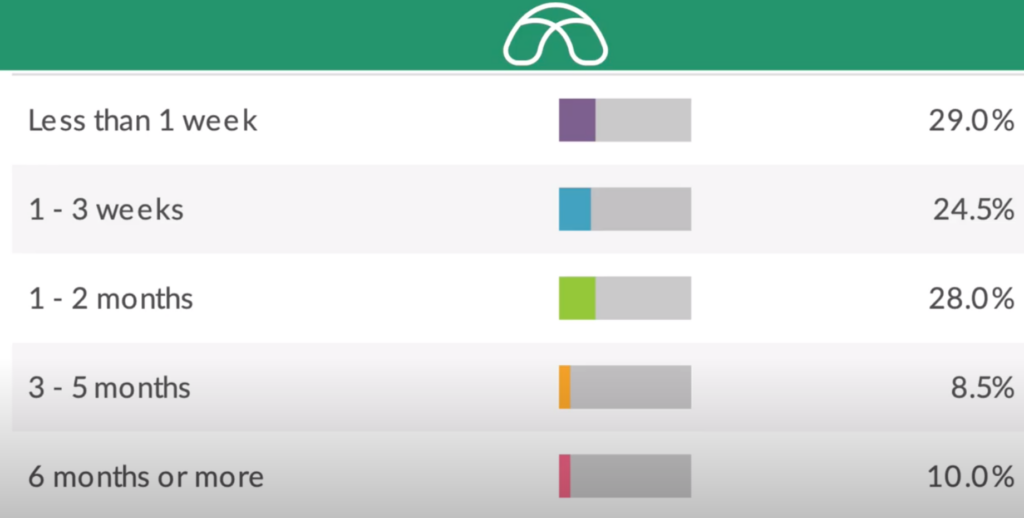

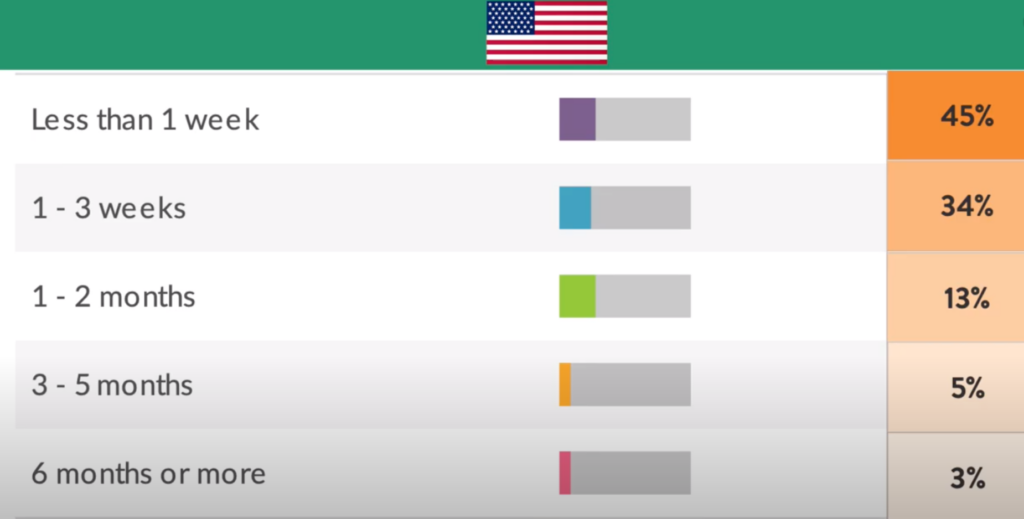

Saving money is never easy. Our results show that majority of the Brigit members (29%) could live off their savings only for a week. This is also true for majority of Americans i.e 45% Americans. We also saw that Americans and Brigit users aren’t confident at all in long time saving goals such for things such as vacations, education, starting a business or paying off loans.

Brigit Responses to the question, “How long do you think your savings can last?”

US population’s Responses to the question, “How long do you think your savings can last?”

Don’t get overwhelmed with these results because it can be tough to allocate some of your cash to a savings account if you don’t have a set goal for that money. Want to learn the art of saving? See our videos below.

Borrowing

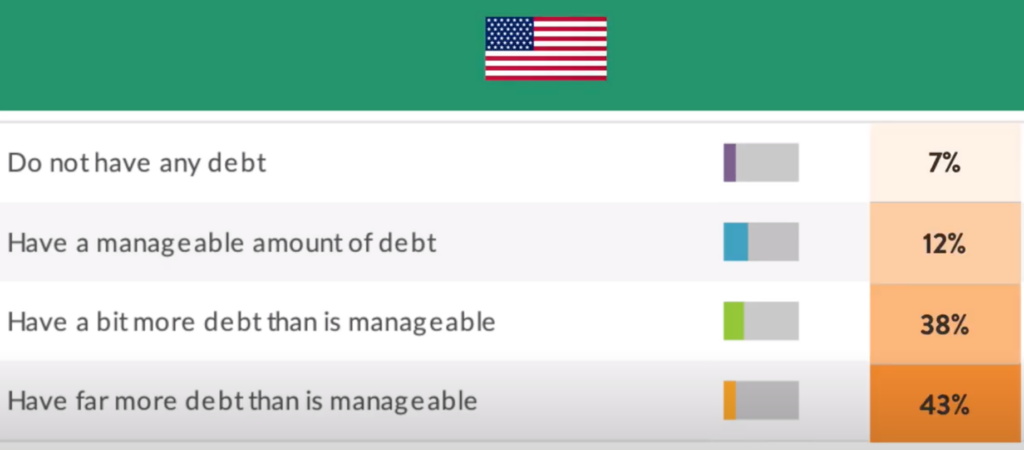

Loans and credit cards are a cornerstone of many American people’s personal finances. People usually borrow money for education, buying a vehicle, important household electronics, and so on. Due to the availability of credit in the market, some of us take on more debt than we can repay. The good news is that majority of Brigit members i.e 35.30% have a manageable amount of debt. Whereas the rest of the country swing towards having far more debt than they can manage.

Brigit Users Response to Borrowing and Debt

US Population’s Response to Borrowing and Debt

If you are in a tough spot and find yourself accumulating debt, don’t beat yourself up right now. Read our blog on how to prioritize your finances to maintain your credit score during the coronavirus crisis.

Planning

Financial planning is an important pillar of better financial health. Luckily, the majority of Brigit users agree with the statement “my household plans ahead financially”. The rest of the country however is unsure and people disagree with that statement. Great job, Brigit users!

Don’t believe us? Watch your survey results for “Planning” below